How do I start trading?

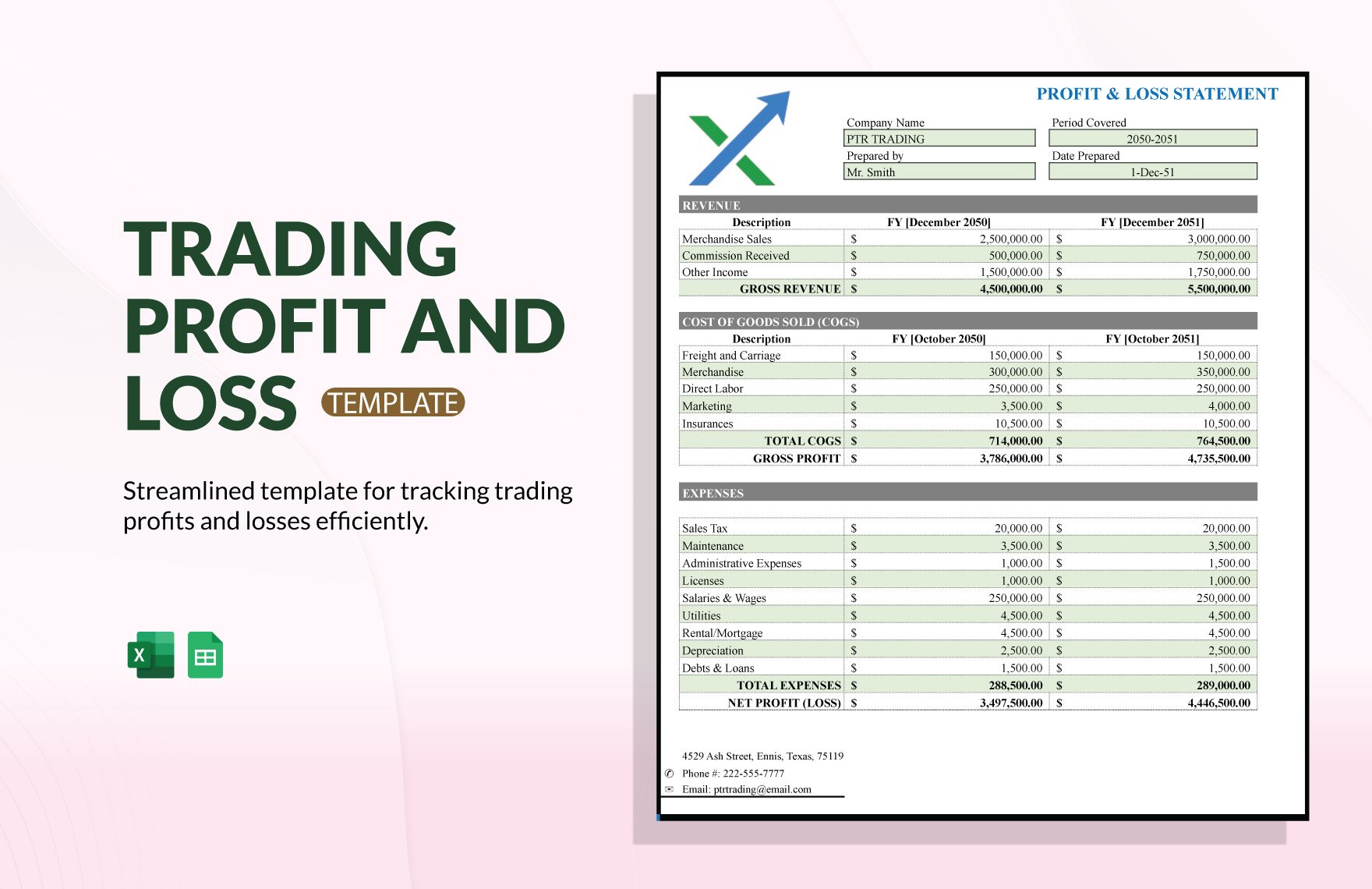

Its educational content, though plentiful, can be a challenge to navigate. Its features include a paper trading account for practice with virtual money, an in app social community for learning from other investors and over 500 courses in its learning center. ET, on the following days. Its charts are also a standout. Difference Between Cash Flow And Fund Flow. Bollinger bands are of 3 types: a middle bang which is a 20 day simple moving average, a +2 standard deviation upper bang and a 2 lower deviation lower band. Using demo accounts for practice is invaluable, especially for beginners. Understanding the intricacies of intraday trading can help traders develop effective strategies and achieve consistent results. It is safe to assume that bulls were able to overcome sellers during that time. With Appreciate app you can. Get it in the Microsoft Store. To learn more about long straddles and additional trading strategies for speculating, check out our educational article Straddles vs. COGS stands for the cost of goods sold. Successful traders often adhere to strict rules about position sizing and employ stop loss orders to limit potential losses. Scalping is a trading strategy that revolves around making numerous trades within a day to capitalise on small price movements of a financial asset. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject Bajaj Financial Securities Limited and associates / group companies to any registration or licensing requirements within such jurisdiction. Late Trading Session: 4:00 p. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. 9, Raheja Mindspace, Airoli Knowledge Park Rd, MSEB Staff Colony, TTC Industrial Area, Airoli, Navi Mumbai, Maharashtra 400708, India. And these normally come in the form of a spread fee. The above is a common trading motto. To talk about opening a trading https://pocketoptiono.website/sr/ account. That practice, called selling order flow, is thought by some to result in customers getting worse prices when they buy or sell investments. ICICI Venture House, Appasaheb Marathe Marg, Mumbai 400025, India, Tel No: 022 6807 7100, Fax: 022 6807 7803. They involve high risk and high rewards. Our first entry could be on the diagonal trend line drawn across the top of the bullish double bottom pattern. Tick charts often reveal ultra short term trends and micro movements, but it’s crucial not to lose sight of the broader picture.

Understanding Trading Accounts: Meaning and Definition

Choosing the right investment app that fits your needs is critical to you reaching your financial goals. Best for professional traders. Your total cash outlay is $37 for the position plus fees and commissions 0. Considering these factors can help you choose a forex trading app that best suits your needs and ensures a safe and efficient trading experience. If you give the correct opinion, you can win much money and transfer it directly to your account. Wondering what professional traders do on a daily basis to improve their skills. If it falls, your buying power decreases. And don’t forget to keep learning about market research, fundamental analysis and technical analysis. The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. Risk Disclaimer: FX Academy will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals and Forex broker reviews. Thereafter, all that remains to be done is to create a trading plan and open a live account. Automatic execution of trade occurs once the price falls to limit order. You might be using an unsupported or outdated browser. Each day, we receive a task via a WhatsApp group, and upon completing these tasks, we earn a 6% profit on our investment, with a 20% tax deduction. Sundays, holidays, and Saturdays are not included in this. The reader bears responsibility for his/her own investment research and decisions. High Quality Education. Profitability in trading depends on market conditions, the trader’s strategy, risk management, and market knowledge. A trading plan sets out the strategies of buying and selling assets, ranging from bonds, stocks, futures, options, FTEs, among other securities. The assets you buy with your cash can be anything offered by that brokerage, including stocks, bonds, ETFs, and even cryptocurrency. Privacy policy Disclaimer Terms of Use. By late 2021, this was above the $40,000 mark. 80% of retail investor accounts lose money when trading CFDs with this provider. As for the trading indicators, I think you can become a successful trader without them, but you must go through countless trials and errors to gain the needed experience. EUR/USD has a margin factor of 2%, so you only have to commit $6677. Starting October 14, Chicago Wheat European Milling Wheat Spread and KC HRW Wheat European Milling Wheat Spread futures will be available for simpler and more capital efficient trading. Com, Interactive Brokers, J.

What do candlestick patterns tell you?

This is not to say that raw materials are not volatile; commodities can be volatile as well, but they tend to stabilize faster than other markets. You can unsubscribe anytime. When one’s outlook on the market is largely bearish, one might use a double options trading strategy called a Bear Call Spread. And what is the number one reason traders surrender to emotions. Additionally, transaction costs, such as brokerage fees and taxes, can erode profits, particularly for frequent traders. These trading disciplines sayings contradict the frequent enthusiasm for leaving strategies to chance, instead backing a structure fortified by experience. Candle Body: The “body” of the candlestick shows the range between the opening and closing prices during a specific time period, such as a day, hour or minute. By analysing the habits of successful fund managers, the book supplies valuable insights into turning trading ideas into profitable actions. There is no one ‘best’ chart pattern, because they are all used to highlight different trends in a huge variety of markets. Traders often use breakouts from key pattern levels to trigger opening or closing out positions. It’s determined by a number of factors, including the amount of time left until the contract expires and expectations for future volatility in the price of the underlying asset. Access and download collection of free Templates to help power your productivity and performance. Fear makes investors act irrationally as they rush to exit the trade. Depending on the type of industry, it can include raw materials, unfinished products, and finished goods. Plus500 is considered a safe broker due to its regulation by multiple reputable authorities, including the Financial Conduct Authority FCA in the UK, the Cyprus Securities and Exchange Commission CySEC, the Australian Securities and Investments Commission ASIC, and the Monetary Authority of Singapore MAS. It provides a comprehensive trading experience with technical and fundamental analysis tools. For instance, avoid trading on more than three trades containing USD as the base currency. Some brokerages require a minimum initial deposit or they charge fees if your balance falls below a certain amount. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Option Volatility and Pricing: Advanced Trading Strategies and Techniques, 2nd Edition

There’s over 180 currencies in the world, so lots of trading opportunities. Webull is best for beginners interested in hand picking commission free stocks, ETFs, and options. Assume you spend $5,000 cash to buy 100 shares of a $50 stock. Related report: What is an Online Brokerage Account. Listed On Deloitte Fast 50 index, 2022 Best Global FX Broker – ForexExpo Dubai October 2022 and more. Apple iOS and Android. The use of AI in trading is expected to have a significant impact on the market. 00 has a max loss of $200 and a max gain of $300 per contract. Why Are Mutual Funds Subject To Market Risks. The simple moving average SMA and. While there is no definitive answer on the average amount of money you can make as an independent day trader, you can vie to become a better trader with each passing day. These traders often have a longer term investment horizon and may hold positions for weeks, months, or even years, waiting for the market to reflect the true value of the assets they’ve identified. Where XTB falls behind is in the area of social trading, where offerings are limited. The Demat or the Dematerialised account reflects all your holdings at a particular time while the trading account is used to buy and sell stocks and other investments. A technical analysis of the share market involves looking at the presently available data on the market and predicting future changes based on the changing scenarios. Copy trading does not amount to investment advice. However, it is important to note that these also come with their own set of terms and conditions that one should understand before doing anything else. This strategy involves taking positions based on the impact of economic releases, company announcements, government policies, or geopolitical developments on financial markets. Within the equity market, there are two main types of shares: common stock and preferred stock. The term “call option” refers to an option to buy a stock, and the term “put option” refers to an option to sell a stock. Store and/or access information on a device. Sometimes it’s you, the situation, market circumstances, or industry trends. Moreover, the rise of HFT algorithms has made it increasingly difficult for individual traders to compete effectively in many markets. Com has all data verified by industry participants, it can vary from time to time. No government can stop you from holding Bitcoin or transacting with others, including big amounts that would usually require multiple enquiries from the banks to put through. When you get started, stock trading information can sound like gibberish. Org does not endorse or suggest you to buy, sell or hold any kind of cryptocurrency. If you don’t have an outstanding day trade margin call, your DTBP will update throughout the day as you execute trades—falling with opening trades and rising with closed day trades. Get the link to download the App.

CmeNCAPersonalisation

So, in order to buy Bitcoin at Kraken, all you need to is a bank account. Leverage can be another reason to trade with derivatives. BSE, along with the National Stock Exchange in India, are the two main houses where stock market trading takes place. The security on this app is diabolical. Measure advertising performance. Buying and trading cryptocurrencies should be considered a high risk activity. 82% of retail investor accounts lose money when trading CFDs with this provider. Lewis was already a successful futures pit trader. Interactive Brokers is best suited for advanced traders and active traders, although beginners can use the web platform and Global Trader for a simpler experience. There are numerous options and paths to explore in the investment world. You must be aware of the risks of investing in forex, futures, and options and be willing to accept them in order to trade in these markets. Practice trading on past data, on any instrument, in any time frame. Such indicators include volume, simple average, moving average, MACD, RSI, etc. Office Address: Plus500CY Ltd, 169 171 Arch. In the Indian context, commodity market timing is bifurcated into two primary sessions, encompassing agricultural and non agricultural commodities. Complete market newbie. It is mandated by SEBI to square off, that is, settle your position by the end of the market hours, or else it will be automatically done by your broker. Come under office furniture requirements.

Detailed, real time statistics

ETFs are grouped together in many different ways, there’s thousands of ETFs out there. Win or lose, sell out. Go back in time with the Trade Replay. Develop a well defined trading plan that outlines your. As for the cybersecurity of the app itself, you can always make sure your trading remains as safe and secure as possible by turning on two factor authentication, keeping your mobile phone software up to date, enable biometric access like FaceID/TouchID, and use a strong password that’s not reused elsewhere. Thanks to zero commission online stock trading and many brokerage firms offering fractional shares, it’s easier than ever to diversify your investments. This article delves into the best indicators for options trading, offering insights into their functionality and relevance in today’s market landscape. Easy Trade Option: Effortless trading for beginners. Download moomoo app today to get free access to 24/7 latest news and discover potential investing opportunities. For example, the trader with the highest return might experience massive drawdowns or could have a very short trading history. Irwin titled “The Profitability of Technical Analysis: A Review”, the three outside up pattern has a success rate of approximately 70% in predicting bullish reversals. Cleanspark CLSK: Average Day Range 30 is 8. ” However, other researchers have reached a different conclusion.

Pros:

Traders should also consider the risk reward ratio of each trade, aiming for setups where the potential profit outweighs the potential loss. Try it out risk free for 30 days – you’ll never look back. Support us by following us on social media, and receive our blog posts on your feed. Scalping involves making frequent trades to profit from small price changes. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. 0001, except for JPY pairs where the pip is equal to 0. However, when using this strategy, the trader doesn’t expect BP to move above $46 or significantly below $44 over the next month. Offer Exclusively For You. Most day traders who trade for a living work for large players like hedge funds and the proprietary trading desks of banks and financial institutions. However, to increase analysis accuracy and trading efficiency, consider incorporating exchange data on real volumes, as well as using professional indicators provided by the ATAS platform and designed to work with them. Have you just started trading or are interested in learning more about the types of trading. The RSI ‘score’ is on a scale of zero to 100. A very good education provider in algorithmic trading. Give customers an experience they will remember. You will be redirected to another link to complete the login. Trader B is a more careful trader and decides to apply five times real leverage on this trade by shorting US$50,000 worth of USD/JPY 5 x $10,000 based on their $10,000 trading capital.

Enter Phone Number to Start Download for Free

To do this, many brokerages have changed their product approach to focus on creating a consistent experience across multiple devices. As of June 2024, ETRADE charges 14. Stocks: Which one is better for you. If you are interested, I have a guide on opening an account at Interactive Brokers and a guide on trading ETFs with Interactive Brokers. No hidden transaction fees. Swing trades commonly last anywhere from 2 6 days but may extend several weeks. The eToro app has all the tools you need to become an investor. Excellent presenteatio.

Brokerage

For instance, if it’s very easy to deposit money but the option to withdraw cash is hidden away somewhere in the app, that doesn’t suggest that the company you’re investing with has the best of intentions. It should be noted that many binary options platforms operate outside regulated financial markets. However, a stock can never go below zero, capping the upside, whereas the long call has theoretically unlimited upside. Client Registration Documents Rights and Obligations, Risk Disclosure Document, Do’s and Don’ts in Vernacular Language: BSE NSE. Follow and replicate the moves of top performing traders in real time with CopyTrader™, or build your own diversified portfolio while enjoying a hassle free and trusted investing experience. Algorithmic trading software is costly to purchase and difficult to build on your own. Futures, options, and spot currency trading have large potential rewards, but also large potential risk. It is no secret that the markets are volatile and can be unpredictable and even risky if not understood correctly. New traders who prefer a longstanding, legacy brokerage should consider Charles Schwab. The three main options trading scenarios are In the Money, At the Money, and Out of the Money. SoFi’s stock trading app caters to a broad audience of investors by offering both taxable and retirement brokerage accounts. Changelly offers a good selection of digital currencies – both large and small. Trade 26,000+ assets with no minimum deposit. State whether the following statement is True or False with reason. All positions that are in a firm’s trading book require capital to cover position risk and may require capital to cover counterparty credit risk. While partners may pay to provide offers or be featured, e. You should consider whether you can afford to take the high risk of losing your money. Swing trading can be incredibly profitable, and is something you should include in your portfolio to complement the daytrading strategies you build. Many people have downloaded its latest version, and everyone has described it as attractive. A wide range of cryptocurrencies available is also important as it provides more options for trading and investing. In addition, Robinhood’s 1% match should appeal to investors looking to open a retirement account.

TDAmeritrade

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. At that point, the difference between the opening and closing exchange rates is 0. The brokers are the registered trading member of exchanges and all the transactions placed are monitored by the regulatory authorities. As security or other investment decisions hinge on accurate market analysis, the trader must meticulously confirm the integrity of the W pattern against false signals. Refer to these for more information. We usually respond within 24 hours. However, our research has uncovered several differences between the two. If you are confused about using it, here are key points that reflect its importance in a business. Please click below if you wish to continue to XS. Looking for an all in one crypto wallet app. And this is a frequent problem. Diverse investing needs. “Investments in securities market are subject to market risk, read all the scheme related documents carefully before investing. The initial margin requirement is set by the trading platform or broker. Finally, Bank of America’s Preferred Rewards loyalty program is the gold standard in banking relationship programs, and Merrill Edge accounts can help you qualify for certain benefits. Your ability to open a trading business with Real Trading™ or join one of our trading businesses is subject to the laws and regulations in force in your jurisdiction. It is impossible to eliminate emotions in trading, but this should not be the goal in the first place. Securities Exchange Act of 1934, as amended the”1934 act” and under applicable state laws in the United States. Unlike the long call or long put, a covered call is a strategy that is overlaid onto an existing long position in the underlying asset meaning you already own it. Its current staking program is a pared down version. If you want to be a day trader, then the $25,000 minimum balance requirement will always apply to your account. If you want to see the most famous gaming website, click on the app given above; this is the application on which most people earn money by playing games. On BlackBull Market’s secure website. These algorithms or techniques are commonly given names such as “Stealth” developed by the Deutsche Bank, “Iceberg”, “Dagger”, ” Monkey”, “Guerrilla”, “Sniper”, “BASOR” developed by Quod Financial and “Sniffer”. To follow and maintain the Statutory requirements. Choose your broker and use the mobile number associated with Aadhar to download their XYZ trading app.

For Investors

If you want to take your trading game to a professional level, Investors Underground can take you there. Moneybox Save and Invest. Scalping demands a significant time commitment from a trader and an ability to handle the stresses of rapid decision making in a volatile market environment. Make sure to experiment with a few different options strategies before putting any real funds into these complex derivatives. Short term news events. This routine can include a premeditated way of starting the day. 0 web platform offers market watch, advanced charting with over 100 indicators, and advanced order types like cover order and good till triggered GTT order, along with fast order placements and other features. The amount of crypto quoted may fluctuate based on market conditions and volatility and the actual amount quoted may at all times be more or less than the amounts shown. The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. Providing those services will cost you money if you need to drive places, catch buses, or use your own vehicle and tools, so budget accordingly. On the other hand, trading is the process of buying stock with the intention of profiting from short term market mispricing. In this article, we’ll break down MCX’s trading hours, holidays, and key information to help new investors get started. One of the first adopters of technology to the financial markets, both algorithmic and active traders have long regarded the company highly for its advanced trading features, highly customizable tools, low margin rates, and alpha generating capabilities. 70% of retail client accounts lose money when trading CFDs, with this investment provider. Create profiles to personalise content. These games typically involve predicting the outcome of a colour sequence, and players can win real cash rewards. Scalping offers several potential benefits for traders who are well suited to its fast paced nature and have a high risk appetite. It’s imperative to be the first to know when something significant happens. In turn, this will then be loaned out to those that wish to engage with crypto loans.

Popular Sections

1 and the US 500 SandP 500 futures market from a spread of just 1 point. However, there is also a possibility of bearing a loss. This frenetic form of trading works by capitalizing on small price movements in highly liquid stocks or other financial instruments. To download the candlestick cheat sheet infographic above, follow these steps. The first part focuses on the firm’s business model, which was developed by two winners of the Nobel prize in economics as well as PhDs from Harvard, and explains its early success in delivering returns of more than 40% between 1994 and 1998. “The time of maximum pessimism is the best time to buy and the time of maximum optimism is the best time to sell. The Three Inside Down candlestick pattern is formed by three candles. Many small profits can easily compound into large gains if a strict exit strategy is used to prevent large losses. Vaishnavi Tech Park, 3rd and 4th Floor. But definitely not as robust as fidelity it seems. Illiquid stocks have lower trading volumes, making it difficult to enter and exit positions quickly without significantly impacting the stock’s price. Neither our company, nor its directors, employees, trainers, or coaches shall be in any way liable for any claim for any losses notional or real or against any loss of opportunity for gain. This example didn’t let us down. Use our trading diary to document thoughts, observations, and lessons from each trade. Valuation of mortgage backed securities, this can be a big simplification; regardless, the framework is often preferred for models of higher dimension. You’ll have to study the company and anticipate what’s coming next, a tough job in good times. Scalpers need to analyse the market thoroughly before engaging in scalping. The price of an asset can trend up or down.

Intraday Trading Jargon Made Easy

Please consult legal and financial professionals for personalized advice based on your specific circumstances. Consequently, Syntax Finance cannot be held responsible for any financial losses or other consequences https://pocketoptiono.website/ resulting from your trading or investment activities. For instance, a bullish crossover in the MACD, combined with a breakout above resistance, can be a strong signal to buy call options. Implied VolatilityImplied volatility is a measure of the expected volatility in the price of an underlying security that’s calculated from current market options prices rather than from historical data about price changes of the underlying stock. Investing your money in the right shares and stocks can earn you significant wealth over five to ten years. For this reason, we want to see this pattern after a move to the upside, showing that bears are starting to take control. All you need is a smart device connected to the Internet to allow you to view and track your investments, and transact in securities conveniently. No more calls with old school brokers, unless you want to. When running this strategy, you want the call you sell to expire worthless. Read all the related documents carefully before investing. But one thing investor should remember is that Intraday Trading is not an easy task. By publishing continuous, live markets for option prices, an exchange enables independent parties to engage in price discovery and execute transactions. Crypto is still a relatively new and burgeoning industry, and customer service has lagged behind what’s available at traditional brokerages. However, as you become more acquainted with the system, you will realize that it’s a simple process. Therefore, candlestick patterns like hammer and bullish engulfing can trigger greed in the market while shooting stars can trigger fear. Like its other apps, IBKR has designed its Mobile app so that users can perform tasks efficiently. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The positions could be long buying the asset first and short selling the asset first. The Trading account is a part of PandL account. Avoid getting caught in the trap of second guessing your positions and follow the exit plan without fail.